Opt Out Of Payroll Tax Deferral Form

Deferral Of Employee Social Security Taxes

Deferring Employee Social Security Payroll Taxes Adp

Payroll Tax Delay Coronavirus Small Business Relief Smartasset

Opt Out Of Payroll Tax Deferral Form のギャラリー

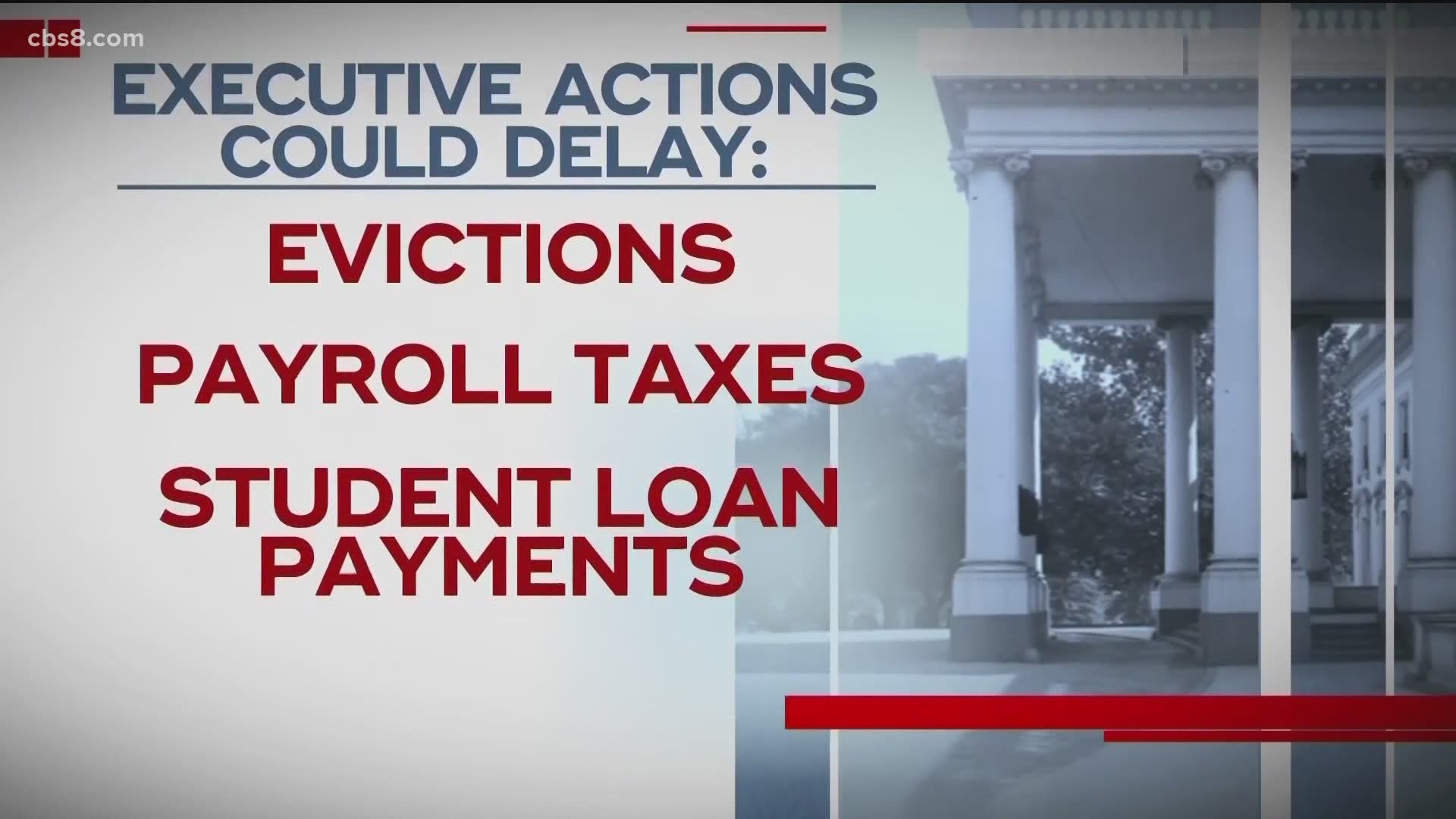

Cbs News 8 San Diego Ca News Station Kfmb Channel 8 Cbs8 Com Cbs8 Com

The Most Common Irs Tax Forms You Re Likely To Come Across When Filing Government Executive

Cmsaf Airmen Usaf Civilians Can T Opt Out Of Payroll Tax Deferral Air Force Magazine

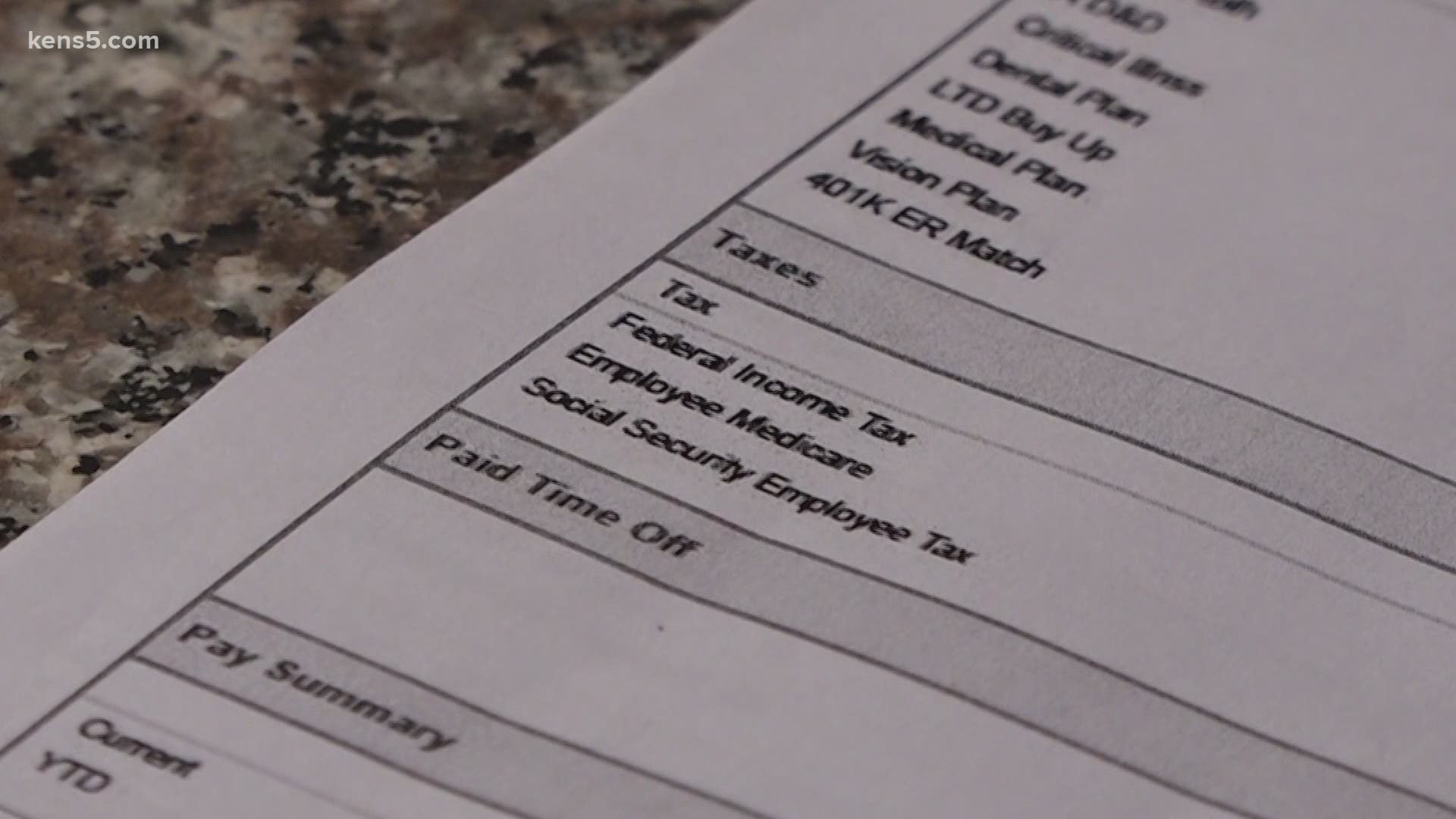

Irs Issues Guidance On Payroll Tax Deferral Kens5 Com

Trump S Payroll Tax Cut Fizzles The New York Times

Questions Remain After Irs Rolls Out Guidance On Payroll Tax Deferral

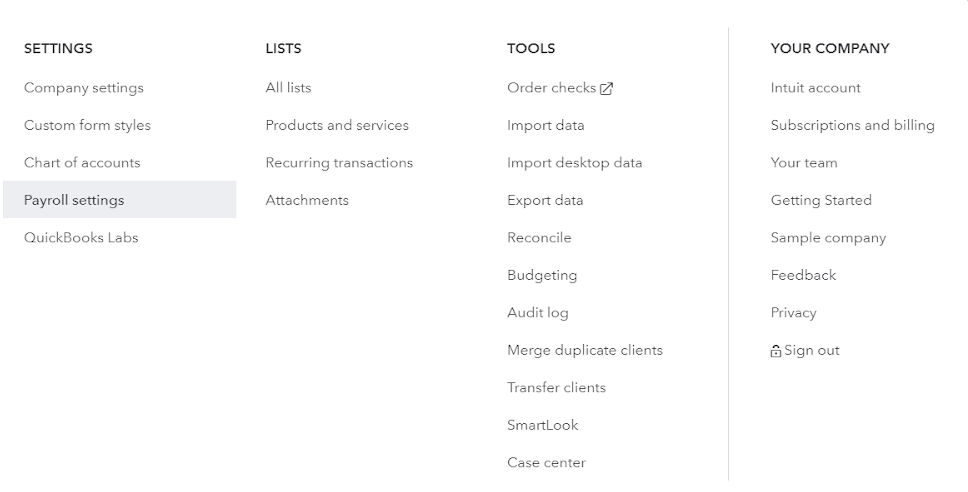

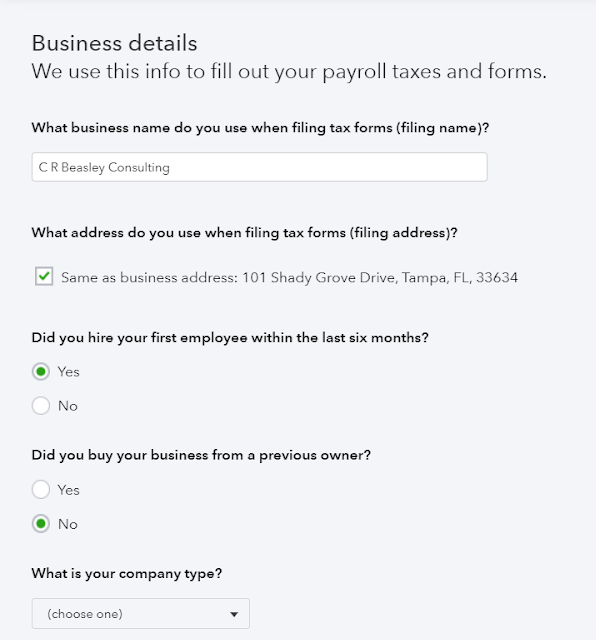

How To Set Up Calculate Pay Payroll Tax Payments In Quickbooks

Deferral Of Employee Social Security Taxes

Senators Urge Administration To Make Payroll Tax Deferral Optional For Federal Workers Thehill

Payroll Tax Cut Truth Time You Might Not Get A Holiday Cnet

Employers Can Defer Payroll Taxes Cobb

Don T Want The Extra Cash Here S How To Opt Out Of The Payroll Tax Deferral Abc13 Houston

Paycor Resource Center A Guide To Common Payroll Tax Forms

Most Employers Not Planning To Offer Payroll Tax Deferral Proposed By Trump Chattanooga Times Free Press

2sbirhxydfljqm

Irs Publishes Frequently Asked Questions On Payroll Tax Deferral Us Employment Law Worldview

How To Manage Payroll Accurately Paycor

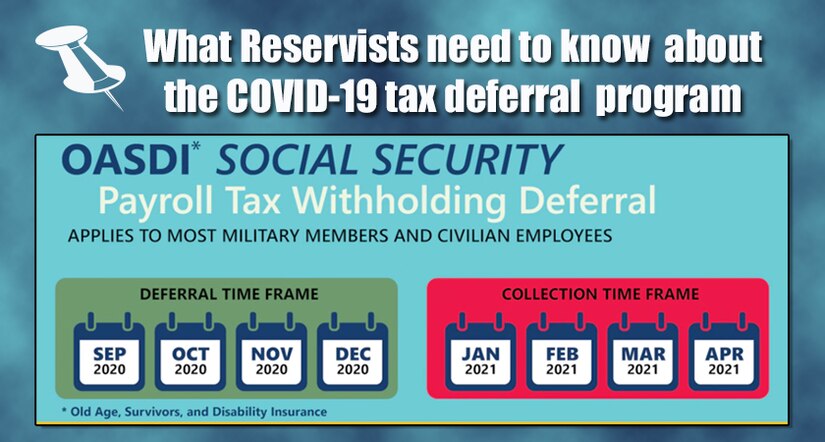

Defense Finance And Accounting Service Taxes Social Security Deferral Military Faqs

These Workers Won T Be Able To Opt Out Of The Payroll Tax Deferral

Xarvfin9wblywm

Irs Issues Guidance On Payroll Tax Deferral Employer Guidelines Cpa Practice Advisor

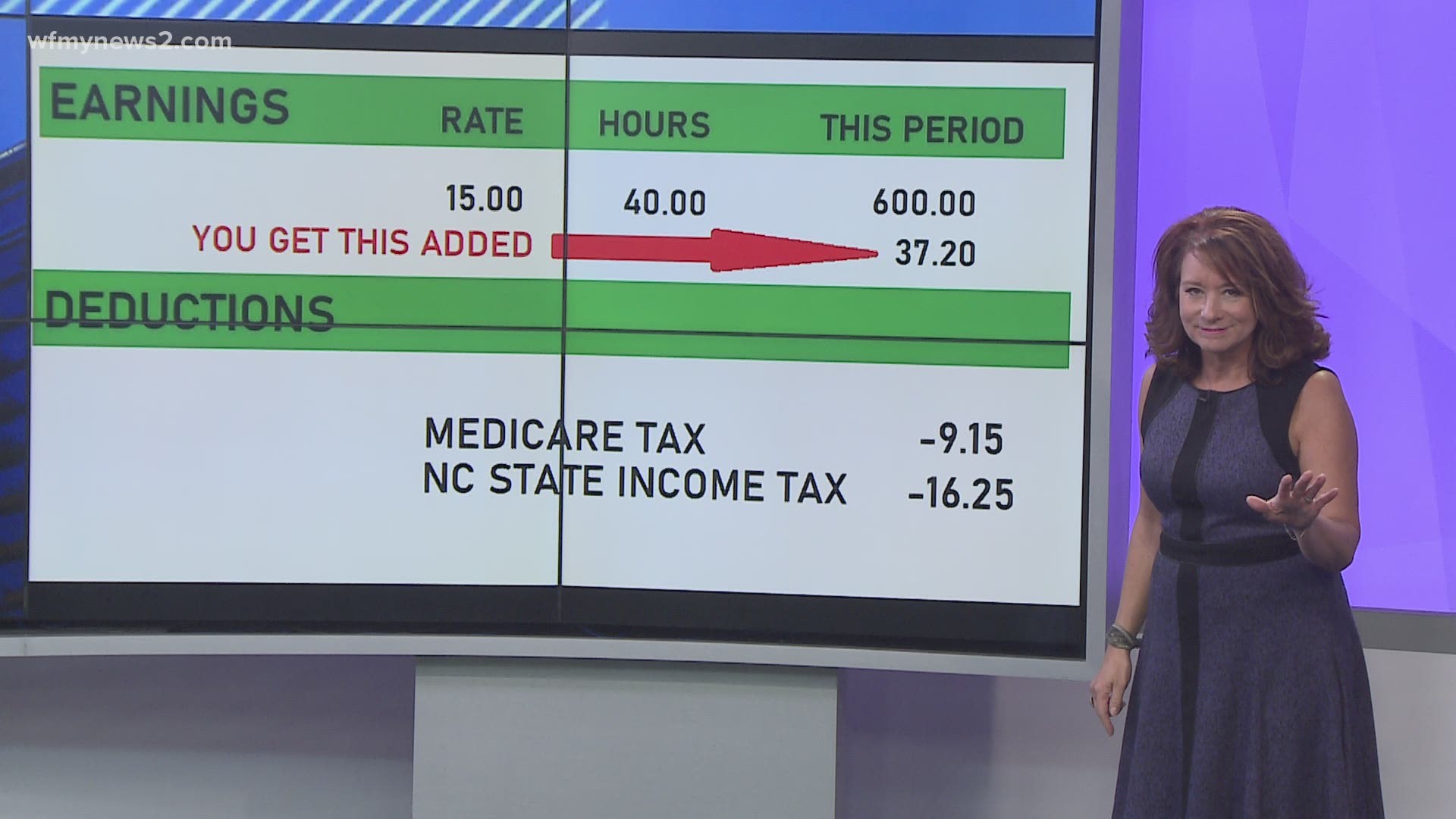

Payroll Tax Deferral What It Means For Your Paycheck

How The Coronavirus Payroll Tax Deferral Affects Pastors The Pastor S Wallet

Implementing The Payroll Tax Deferral Journal Of Accountancy Podcast

Military Members Can T Opt Out Of Trump S Payroll Tax Deferral Thehill

Us Covid 19 Deferral Of Employer Payroll Taxes Help Center

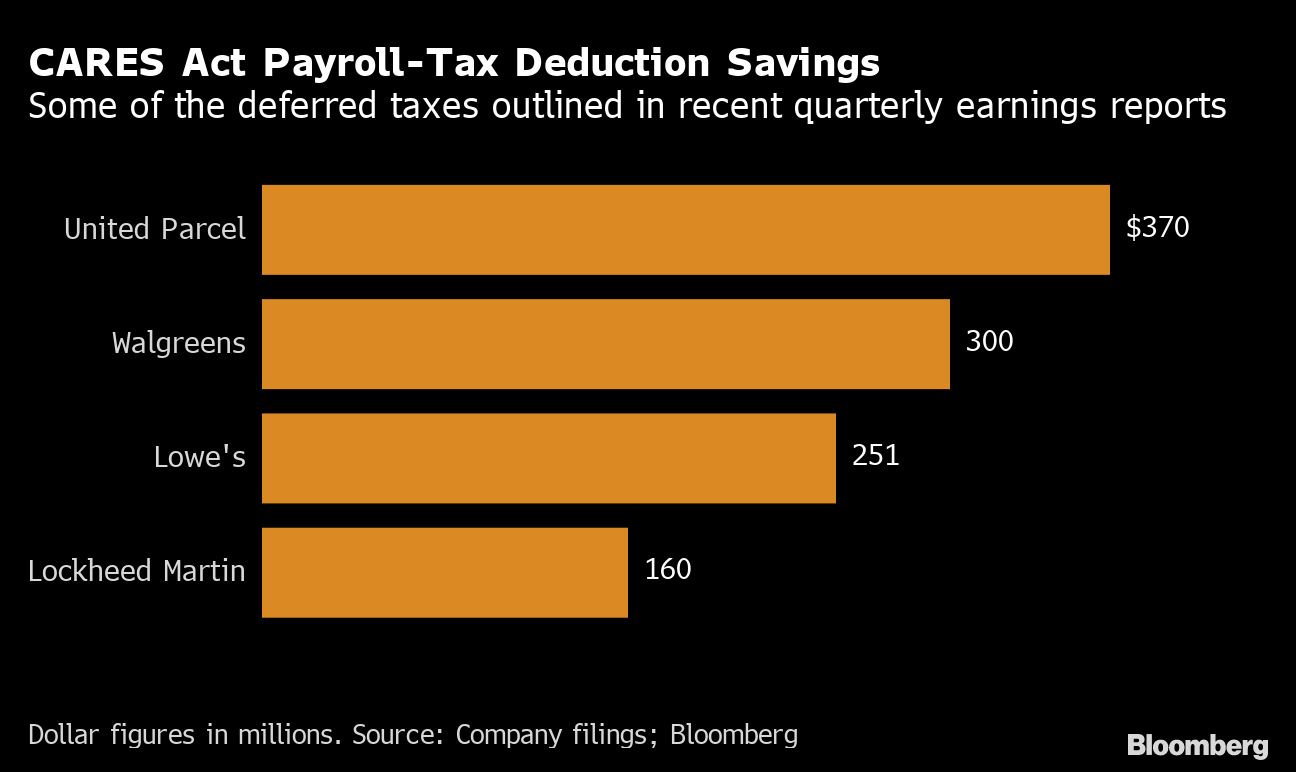

New Payroll Tax Benefits For Businesses Can Provide Substantial Relief Commercial Observer

Trump S Payroll Tax Cut Is A Loan That Employees Will Have To Pay Back The Washington Post

What Is Irs Form W 3

Covid 19 Tax Credit Record Justworks Help Center

1 3 Million Active Duty Troops Will Have Payroll Taxes Deferred Can T Opt Out Business Insider

These 70 Employers Opted Out Of Trump S Payroll Tax Deferral Did Yours

Payroll Tax Deferral Not Popular Among Small Businesses Washington Business Journal

Irs Releases An Early Draft Of The W 4 Integrity Data

Will Trump S Payroll Tax Deferral Boost Your Paycheck Maybe For A Time If Your Employer Participates But It S Not Free Money The Seattle Times

These 70 Employers Opted Out Of Trump S Payroll Tax Deferral Did Yours

Irs Issues Payroll Tax Deferral Guidance

Irs Finalizes Updates To Form 941 For Covid 19 Tax Credits Integrity Data

Q Tbn 3aand9gctzkwhchxhfj5p 7n6gvapgvn0bwqpuzua8ysf1jdflfsdn3vii Usqp Cau

Irs Issues Guidance For Executive Order On Payroll Tax Deferral Sikich Llp

Irs Issues Guidance On Payroll Tax Deferral Wnep Com

Here S What The Payroll Tax Deferral Action Means For You Wsmv Com

Payroll Tax Deferral Takes Effect Tuesday What It Means For Your Check Wkyc Com

Defense Finance And Accounting Service Dfas Posts Facebook

Irs Issues Guidance Clarifying President Trump S Payroll Tax Deferral

Employee Payroll Tax Deferral Guidance Explore Our Thinking Plante Moran

Payroll Tax Deferral What It Means For Your Business And Employees

How Covid 19 Is Directly Impacting Your Payroll

Lawmakers Make Last Ditch Push For Payroll Tax Deferral Opt Out Government Executive

Customer Support During Covid 19 Paychex

Irs Publishes Faq On Payroll Tax Deferral Provides More Immediate Cash To Businesses

Covid 19 Tax Credit Record Justworks Help Center

The Payroll Tax Deferral Means Less Taxes Now More Taxes Later Wfmynews2 Com

Trump Wants Employers To Defer Your Payroll Taxes And Boost Your Paycheck Here S Why Many Probably Won T Cnn

Treasury Issues Payroll Tax Deferral Guidance Center For Agricultural Law And Taxation

Us Covid 19 Deferral Of Employer Payroll Taxes Help Center

/GettyImages-92223836-57a5356b5f9b58974ab7e971.jpg)

Trump S Payroll Tax Deferral What Should You Do

Trump S Payroll Tax Deferral Is Supposed To Start Today But Won T For Many Workers

The President S Action To Defer Payroll Taxes What Does It Mean For Your Business Sensiba San Filippo

Payroll Tax Deferral What It Means And How It Affects Your Money Ksdk Com

What The Payroll Tax Deferral Means For Soldiers Article The United States Army

Here S What You Need To Know About A Payroll Tax Holiday Khou Com

Payroll Taxes Businesses Say Trump S Executive Action Is Unworkable Cnnpolitics

Q Tbn 3aand9gctcia3b 1scw5vc8osxhg5mmiiqczt1o1gtvtaoaasiuzqytu6l Usqp Cau

U S Payroll Tax Deferral Who Is Eligible Why Your Company Might Not Participate And More Faqs Pennlive Com

The Payroll Tax Deferral Dilemma Blogs Labor Employment Law Perspectives Foley Lardner Llp

Payroll Tax Cut Truth Time You Might Not Get A Holiday Cnet

Aicpa Asks Irs And Treasury For More Clarity On Trump S Payroll Tax Deferral Accounting Today

How To Set Up Calculate Pay Payroll Tax Payments In Quickbooks

Www Nprc Inc Org Blog Wp Content Plugins Download Attachments Includes Download Php Id 457

Lacking Time And Guidance Businesses Won T Defer Employees Payroll Taxes

Irs Notice 65 Payroll Tax Deferral Guidance

.png)

Irs Begins Payroll Tax Deferral Employers May Suspend Social Security Withholdings Through Dec 31

Anad6pmw7l6v0m

What You Need To Know About The Deferral Of Payroll Tax Obligations

What Employees Need To Know About The Social Security Payroll Tax Deferral

rp Opposes Payroll Tax Deferrals

Irs Guidance Allows Workers A Payroll Tax Holiday

It S Not Free Money Payroll Tax Deferral Has Implications The Lima News

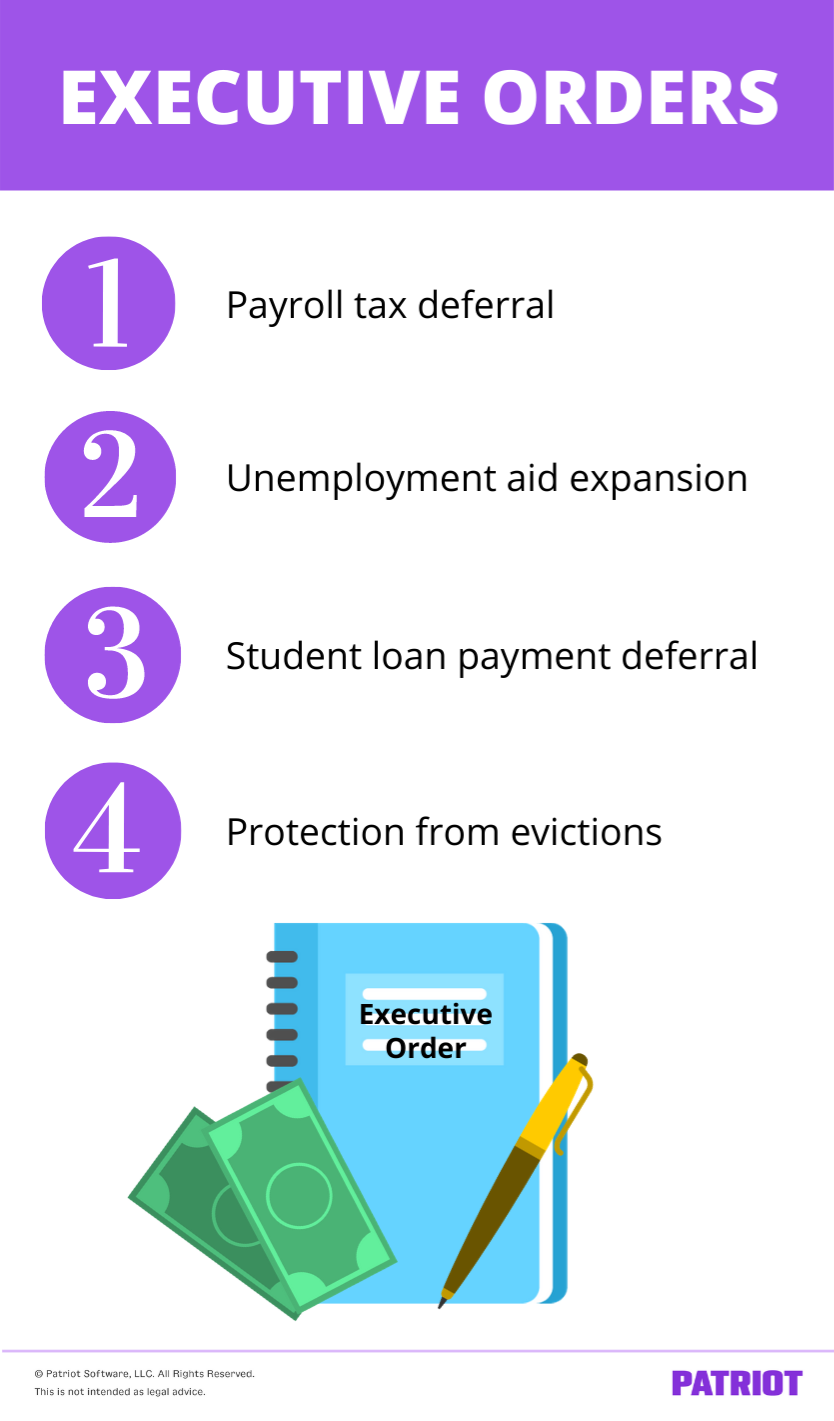

The Executive Orders And Your Business Irs Payroll Tax Deferral More

Us Covid 19 Deferral Of Employer Payroll Taxes Help Center

Memo Outlines Plan To Defer Payroll Taxes For Federal Employees Politico

1 3 Million Federal Workers Will Have Payroll Taxes Deferred Under Trump Directive Business Insider

Deferring Employee Payroll Taxes What You Need To Know Workest

Employers Hesitant Confused Over Payroll Tax Suspension

Employer Forms For Payroll Hr Administration Complete Payroll

Union Urges Trump Administration To Make Payroll Tax Deferral Optional For Federal Employees Thehill

Employee Social Security Tax Deferral Irs Notice 65

How Trump S Executive Order Tax Deferral Affects Employees Businesses

3

Employment Taxes 101 An Owner S Guide To Payroll Taxes

4 Ways To Avoid Owing Payroll Taxes In 21

Aicpa Requests Guidance On Trump Payroll Tax Deferral Memo Cpa Practice Advisor

1

Questions Remain On Payroll Withholding Policy

Irs Defers Employee Payroll Taxes Jones Day

The Executive Orders And Your Business Irs Payroll Tax Deferral More

Deferral Of Employee Social Security Taxes

Senate Supreme Court Opt Out Of Trump Payroll Tax Deferral Accounting Today

Covid 19 Relief Justworks Help Center

Draft Form 941 Issued To Add Line To Deal With Payroll Tax Holiday Employee Oasdi Tax Deferral Current Federal Tax Developments